Horizon Construction’s research into the region’s construction industry shows optimism and a positive outlook for the next 12 months as it emerges from the COVID-19 pandemic.

After fundamental changes to working practices and the economic impact on core construction sectors, firms are positioning themselves for renewed growth through a mixture of new and old working methods. This article looks at the research to identify key trends in the region’s construction industry.

Background

The team at Horizon Construction has always taken a forward-thinking approach to construction. Through collaboration with key contacts in the industry, they share their research into how the industry is expected to perform over the coming months.

A survey was sent to architects, project managers, developers and a selection of clients operating across East Anglia, London and South East. 40 people representing senior construction roles within 37 different companies completed the survey in April 2021. (See section “Additional information” for information about the respondents.)

The impact of COVID-19

The construction industry has not been immune to the effects of the COVID-19 pandemic and restrictions within the economy. Even though it is an industry that has been allowed to continue during the restrictions, much disruption has occurred which has affected all areas of business. Certain sectors in the industry have experienced significant growth, such as private/domestic sector repair and maintenance works and the residential construction sector, whilst all other sectors have been challenged with changes in demand and contractual and operational difficulties. Projects have been cancelled or, at best, postponed until confidence returns. Constraints on the supply of construction materials during the pandemic, combined with new operational procedures, have also been factors in delayed projects and operational liquidity.

Before the pandemic, the industry thrived on a traditional approach to building relationships. Meetings were face-to-face, agreements were completed with handshakes, relationships were maintained through social events, and office-based workers spent most of their time at an office. Even with the rise of cloud-based technology, the construction industry fell behind other industries over its adoption. However, the imposed restrictions and guidelines, because of the pandemic, fundamentally changed the industry’s approach to business. Firms have been forced to think differently about how to conduct business and to maintain relationships.

Key tends in construction

The research discovered over a quarter of the respondents (28%) felt the industry had fundamentally changed for the long-term due to COVID-19. The majority (60%) felt the industry would become balanced with a mixture of new and traditional methods of operation. Whilst 13% thought the industry would return to traditional methods. (See Diagram 1.)

Managing Director at Horizon Construction, Phil Holding, commented: “Whilst our staff have become very familiar with a range of new technologies to maintain relationships with our clients, we look forward to, once again, being able to have face-to-face meetings and events. Virtual and online technologies now play an important role in enabling efficiencies and additional communications, but nothing compares to in-person meetings and handshakes. The industry has deep roots in developing business relationships using traditional activities. Therefore, we believe the future is a hybrid between new and old approaches to construction.”

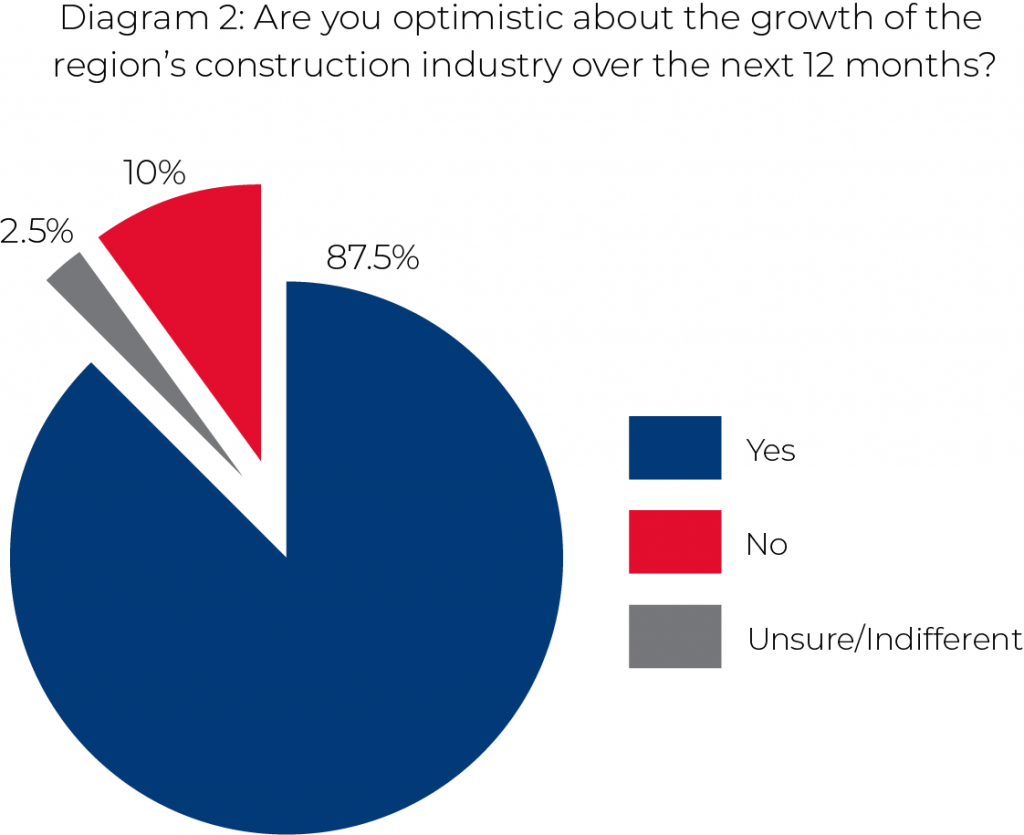

Overwhelmingly, 88% of respondents were optimistic about the growth of the region’s construction industry over the next 12 months. There was confidence in their existing range of services, with little need to diversify in new or other areas of expertise. In addition, respondents are looking to expand their current operations which will be supported by recruiting new skills within the workforce. There was no suggestion that liquidity will be a factor preventing their future growth and will be developing new approaches to sales and marketing practices for lead generation and promotional activities. (See Diagram 2.)

Customers are looking for reliability, service quality and satisfaction as leading considerations to ensure confidence in their projects when procuring services. Whilst pricing sensitivity is the next most important factor. A firm’s approach to corporate social responsibility – the act of being socially accountable to itself, its stakeholders, and the public – was of noteworthy importance, and it was surprising to see health and safety and financial performance as lesser important factors in the expected decision-making process.

The largest risk to growth opportunities in the industry is the continued impact of COVID-19. Continued nervousness from investors due to economic conditions will affect the commissioning and delivery of projects. During the heavy grip of the pandemic over the last year, as well as the added impact of Brexit, firms in the industry have been pricing projects, in many cases, to ensure their survival. In a previously low margin industry, this has created additional pressures on firms in a fiercely competitive environment, which has, without doubt, benefited customers. The recently added strain for firms is the rising cost of construction materials, so there is an expectancy to build in an adequate factor for pricing variance in projects to allow for fluctuations in raw material costs.

Another topic that has become ever more important over the last 12 months is environmentalism and the protection of our climate. Already mentioning changes to working practices and the consideration of corporate social responsibility, the research identified low carbon approaches and technologies in construction as leading themes over the next 12 months. This included the use of renewable energy products and the decarbonisation of existing buildings.

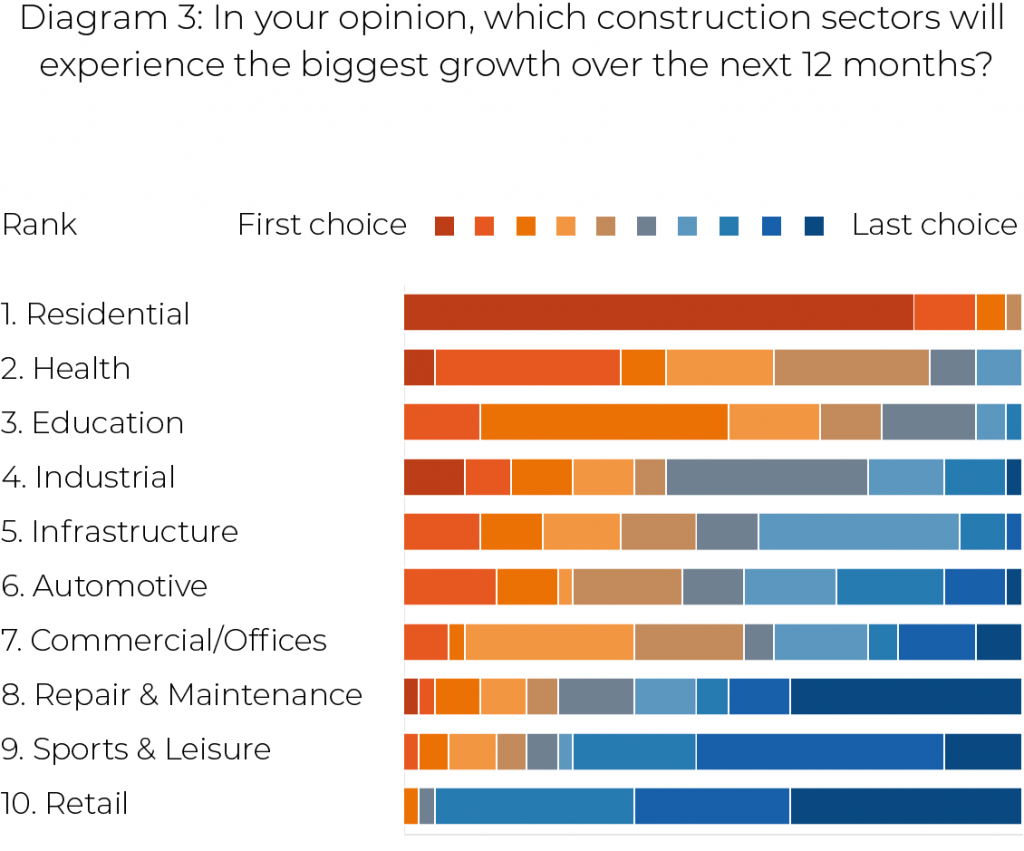

Growth rates across construction sectors will remain affected over the next 12 months due to economic influences from COVID-19 and Brexit. Growth of the commercial and office sector will be influenced by the continuation of remote working practices and growing cases of businesses moving operations away from larger cities as well as reducing the scale of existing facilities. The recent growth of the repair and maintenance sector is expected to reduce. Retail, sports and leisure sectors probably require little explanation why they have been affected and will continue to have low construction activity. Private and public sector capital investments will see growth areas in health, education, industrial and infrastructure sectors. However, the sector with the highest expected growth, by far, is residential construction – 82.5% of respondents ranked this sector as their first choice. (See Diagram 3.)

For further information about the research, including press and media enquiries, please contact us.

Additional information

- Click here for the PDF download of the survey results.

- Click here for the press release.

Key points from the research:

- COVID-19 has fundamentally changed how firms operate in the construction industry.

- A balanced approach with traditional operational methods is expected in the future or longer-term outlook.

- Firms have been affected by cautious investors due to economic conditions which have led to changes in growth opportunities in specific sectors.

- Firms are concentrating efforts on sales and marketing activities over the next 12 months to ensure they remain competitive.

- Firms are wanting to develop the scale of their existing operations and services through the recruitment of additional skills within their workforce.

- Environmentalism is changing the approach to construction, with a focus on low carbon and renewable energy products in new constructions.

- Firms are confident about the growth of the region’s construction industry.

Key points from the survey results:

- The survey was completed by 40 people, representing 37 different firms involved in the construction industry – please contact us to request the list of respondents (business names only).

- Those firms provide services within East Anglia (45%), London (27%) and/or South East (28%). On average, each firm operates across 2 regions.

- Represented areas of construction were Architects (20%), Project Managers / PQSs (20%), Developers (20%), Key Subcontractors (28%) and Direct Clients* (12%).

*Direct clients to Horizon Construction. - The two most concentrated construction sectors for services were Residential (88% of respondents) and Commercial/Offices (70%).

- The least concentrated construction sector for services was Infrastructure.

- Approaches to environmental and low carbon methods of construction are expected to be the biggest trends in construction over the next year. ‘Low carbon approach to new constructions’ was the leading trend. Environmentalism outweighed changes and approaches to construction methods and processes in design, systems and machinery.

- The continued impact of COVID-19 is expected to be the largest factor affecting growth opportunities in the construction industry, combined with cautious investors due to associated economic conditions and the continued aftereffects of Brexit.

- The lower concerns to affect growth opportunities are regulation and legislation and barriers over the adoption of new technologies.

- With the news of rising raw material costs in recent months, which are expected to continue, it was the 5th factor out of 7 to impact growth. The expectancy is firms will build in a factor for pricing variance in projects to allow for changes in raw material costs whilst considerate of remaining competitive. Pricing was the second largest first choice for factors in procurement decisions.

- The continued impact of Brexit and shortage of skilled labour / human resource respectively came in at positions 3 and 4 on factors affecting growth.

- Over the next 12 months, the Residential sector is by far the first choice for respondents (82.5%), followed by Health and Education.

- Retail sector is expected to be the smallest area of growth/performance in the next 12 months, which is likely due to the impact of COVID-19 and changes to retail buying behaviours.

- Repair and Maintenance sector, even after strong growth during 2020, is now expected to fall away – in 8th position (out of 10) in growth areas.

- Challenging time expected for Commercial/Offices sector, probably due to the pandemic. Continuation of remote working and decisions to move away from larger cities and/or to reduce scale of facilities within larger cities.

- Industrial sector is expected to perform better than Infrastructure and Automotive.

- Customer service quality/satisfaction is the biggest consideration on the procurement of construction services over the next 12 months. Sales (including pricing) and marketing themed practices are the largest areas of consideration in procurement.

- Health and safety, financial performance and accreditations/certifications are the least concerning factors influencing the procurement of services.

- Focusing on sales and marketing activities are the leading areas for biggest improvements and methods to assist with new lead and enquiries.

- Respondents seem to be confident in their current areas of construction – no strong indication they need to develop new services to remain competitive. Perhaps also a suggestion that respondents are wanting to expand their current operations by recruiting new skills within the workforce. There is no suggestion that liquidity is a factor preventing their growth.

- Limited suggestions that the implementation of new technologies in the construction process is not an immediate concern or priority to attain competitive advantage.

- When asked about whether COVID-19 has had a fundamental and long-term impact on the way firms operate in the construction industry, the majority (60%) believe the industry will become balanced with a mixture of new and traditional methods of operation. 28% believe the industry has fundamentally changed for the long-term and 13% believe the industry will return to traditional methods of operation.

- Overwhelmingly, 88% of the respondents are optimistic about the growth of the regional construction industry over the next 12 months.